2021/2022 Most Active VC Investors in Sweden and the Nordics by Investment Stage

The VC market is dry, you’ve heard it and maybe even felt it. But — THE SHOW MUST GO ON! And so it goes, VCs are still actively investing. The question is, who is actually active in Sweden and the Nordics, and at what stage?

This article is for you entrepreneurs that don’t want to waste time, and go back to building. Never underestimate fundraising though, it takes time and dedication (if you want some tricks and tips scroll to the bottom).

But first a Disclaimer. Public data = proxy only!

- Everything is based on public data. That means, a good proxy, but certainly not the entire truth.

- 2021 to mid-2022 means rounds announced from January 1st 2021 to July 31st 2022 (19 months).

- We do not distinguish between lead investor participation, and smaller tag-along positions. For the graphs we’ve therefore only included VCs that at least sometimes lead rounds, and excluded a few others. However, these are included in the “complete list” that you find at the end of the article.

- We do not explicitly distinguish between initial investments and follow-on round participation, which means the median in the graph may have a tendency to be slightly higher than the actual median of entry round participation in reality.

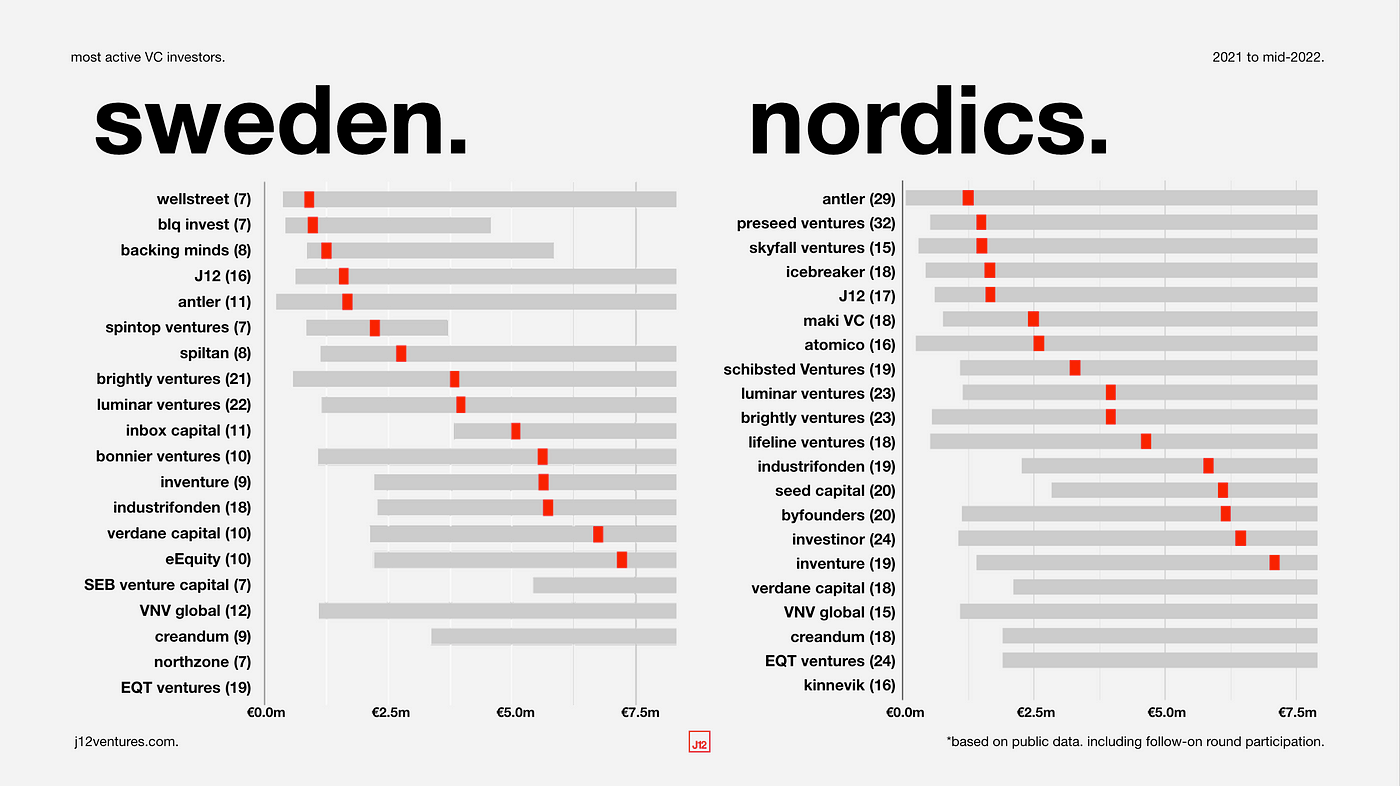

The Most Active VC Investors in Sweden 2021 to mid-2022

Graph explained: it shows the 20 most actively investing VC firms in Sweden from January 1st 2021 to July 31st 2022 ranked by the median round size in which they participated (red bar), as a proxy for the stage at which these firms typically invest at. The gray bar from left to right shows the total range, minimum to maximum of round sizes in which the VC has participated in, in Swedish companies, during that period.

The 20 most active VC investors in Sweden by number of rounds participated in:

The Most Active VC Investors in the Nordics 2021 to mid-2022

Graph explained: it shows the 21 most actively investing VC firms in the Nordics from Jan 1st 2021 to July 31st 2022 ranked by the median round size in which they participated (red bar), as a proxy for the stage at which these firms typically invest at. The gray bar from left to right shows the total range, minimum to maximum of round sizes in which the VC has participated in, in Nordic companies, during that period.

The 21 most active VC investors in the Nordics by number of rounds participated in: